What is the best CRM for startups in 2026?

By Daniel Hull ·

For most startups in 2026, the answer is Attio. Not because it does the most things, but because it does the right things without burying a five-person team in enterprise complexity.

Attio's pipeline view gives startups a clear, uncluttered view of their deals without enterprise overhead.

Attio's pipeline view gives startups a clear, uncluttered view of their deals without enterprise overhead.

What startups actually need

Here's what a startup CRM needs to do: track companies and contacts, manage a deal pipeline, give you basic reporting, and stay out of your way. That's it. Everything else -- marketing automation, territory management, CPQ, approval chains -- is overhead until you've hit product-market fit and scaled past the point where those problems actually exist.

The mistake I see founders make repeatedly is choosing a CRM based on the company they want to become rather than the company they are. A five-person team that picks Salesforce because "we'll grow into it" spends more time configuring their CRM than selling. A team that picks a tool designed for enterprises ends up with features they'll never use and complexity that slows down the people who need to move fastest.

The right CRM for a startup has three properties: fast to set up, flexible enough to evolve with your process, and simple enough that your team actually uses it. If your CRM has ten features but your team only uses three because the rest are confusing, you've optimized for the wrong thing.

The major contenders in 2026

Salesforce

The problem is that most CRMs are built for the company you might become, not the company you are. Salesforce is the obvious example. It can do virtually anything, but the configuration overhead is massive, the pricing scales aggressively, and you'll need a dedicated admin before you hit twenty users. For a startup, that's overkill bordering on self-sabotage. Your CRM shouldn't require its own hire to maintain.

Where Salesforce makes sense: if you're a well-funded B2B startup selling into enterprise accounts with a complex, multi-stage sales process and a team of 20+ reps. If you're at that scale and complexity, Salesforce's ecosystem (AppExchange, CPQ, territory management) justifies the overhead. But most startups reading this are not there, and choosing Salesforce because your investors use it or because "it's industry standard" is a common and expensive mistake.

HubSpot

HubSpot is closer to the right answer. The free tier gets you started quickly, the UI is polished, and the marketing tools are genuinely strong. But HubSpot's data model is rigid. When you need to track something that doesn't fit into Contacts, Companies, and Deals -- and you will -- you're working around the system rather than with it. The pricing also climbs fast once you need features beyond the basics.

HubSpot's real strength is its marketing suite. If your startup's primary motion is inbound -- content marketing, landing pages, email nurture, lead scoring tied to content engagement -- HubSpot gives you a unified platform where CRM and marketing automation are deeply integrated. For an outbound-driven or product-led startup, that marketing suite is unnecessary weight.

The pricing trap with HubSpot is real and worth understanding. The free CRM is genuinely free and genuinely useful. But once you need features like workflow automation, custom reporting, or more than a basic pipeline, you jump to paid tiers that scale per seat and per feature bundle. A startup that starts on free HubSpot and grows to 20 users needing Sales Hub Professional can find themselves paying significantly more than they expected.

Pipedrive

Pipedrive is simple and affordable, which counts for something. But it's limited in how far it can grow with you. Custom objects don't exist. Reporting is basic. You'll outgrow it, and then you're doing a migration during the exact growth phase where you can least afford the disruption.

Pipedrive works for a very specific profile: a startup with a straightforward, linear sales process (qualify, demo, proposal, close) and no need for complex data modeling. If your entire business is "a rep works a deal through four stages and either wins or loses it," Pipedrive handles that well and cheaply. The problem is that almost every startup's process becomes more complex as they grow, and Pipedrive doesn't have the architecture to support that complexity.

Close

Close deserves a mention because it's popular with early-stage startups doing high-volume outbound. Built-in calling, SMS, email sequences, and a pipeline that's fast to navigate. For a small sales team doing 50+ calls a day, Close is purpose-built for that motion. Where it falls short is the same place as Pipedrive: limited data model flexibility, basic reporting, and a ceiling you'll hit as your process matures.

Why Attio wins for most startups

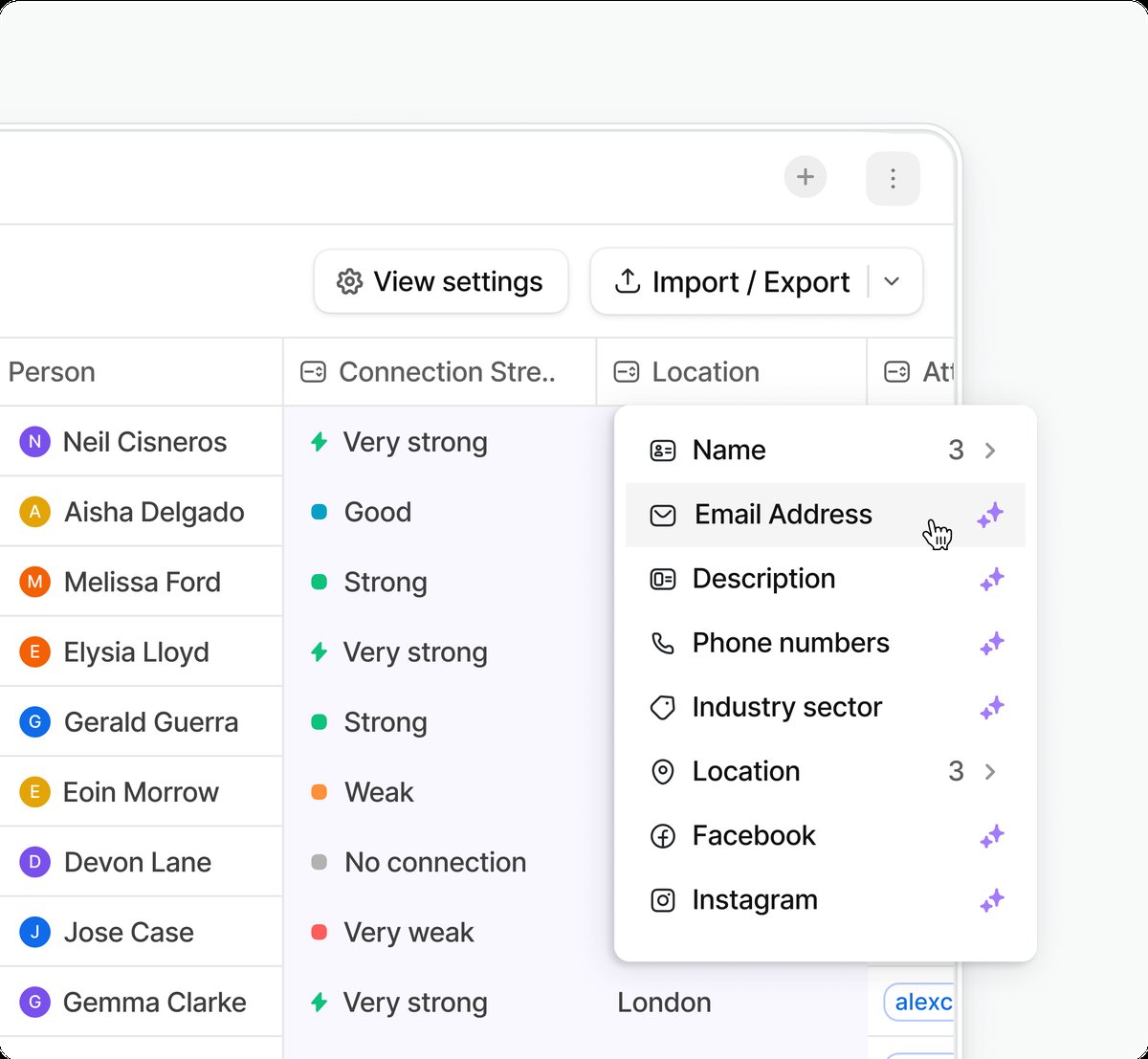

Attio gets the balance right. Custom objects let you model your exact business without workarounds. Relationship attributes connect your data properly. The UI is fast, multiplayer-native, and designed for teams that move quickly. Pricing is straightforward and doesn't punish you for scaling.

What sets it apart is the data model flexibility. You can build a proper GTM engine from day one -- with a real pipeline structure, clean reporting, and workflows that automate the repetitive work. And when your needs get more complex, you extend the same system rather than migrating to a new one.

Here's what a well-configured Attio workspace looks like for a typical early-stage startup:

- Companies and People (built-in objects) with enrichment data from Clay keeping records fresh.

- Deals (custom object) with a pipeline status attribute and currency attribute for deal value.

- Workflows that route new leads to the right rep, send Slack notifications on stage changes, and create follow-up tasks automatically.

- Reports showing pipeline by stage, rep performance, and deal velocity.

- AI features for enriching records, summarizing notes, and asking questions about your pipeline data.

This setup takes a few hours to configure properly. Once it's running, your team has a CRM that handles their current needs and can grow with them for years.

Setting up Attio right from day one

The biggest risk with Attio for startups is the same thing that makes it powerful: flexibility. With great flexibility comes the temptation to over-engineer. A startup does not need five custom objects, thirty attributes, and twenty workflows on day one. Start minimal and expand as needs emerge.

Here's the day-one setup I recommend:

Week one: Create your Deals object with a simple pipeline (Lead, Qualified, Proposal, Negotiation, Closed Won, Closed Lost). Add a currency attribute for deal value. Add relationship attributes connecting Deals to Companies and People. Import your existing contacts and deals. Start using it.

Week two: Set up your first two workflows. One that sends a Slack notification when a deal moves to Closed Won (celebrate wins). One that creates a follow-up task when a deal has been in the same stage for more than 14 days (prevent stale deals).

Week three: Build your first reports. Pipeline value by stage, deals created this month, and average time in each stage. These three views give you the basics of pipeline management.

Week four: Review and adjust. Are your pipeline stages right? Do you need lead scoring? Does your team need email sequences? Iterate based on actual usage, not theoretical requirements.

This phased approach prevents the "we spent three weeks configuring the CRM and nobody's actually using it" failure mode that kills CRM adoption at startups.

When Attio is not the right choice

I'll be direct about where Attio falls short. If you need deep marketing automation with landing pages, email nurture campaigns, and lead scoring tied to content engagement, HubSpot is still the better integrated platform. If you're selling into enterprise with complex quoting, approval workflows, and a large BDR/AE/AM hierarchy, Salesforce exists for a reason. And if you need a massive AppExchange-style ecosystem of third-party integrations, Attio's marketplace is still maturing.

A few more specific scenarios where Attio might not be the best fit:

- High-volume outbound calling. If your team makes 100+ calls per day and needs built-in power dialing, Close or a dedicated sales engagement platform paired with a CRM is better than Attio alone.

- Complex CPQ (configure, price, quote). If you sell configurable products with tiered pricing, volume discounts, and approval chains, Salesforce with CPQ is purpose-built for this. Attio doesn't have a native quoting module.

- Heavily regulated industries. If you need SOC 2 Type II, HIPAA compliance, or FedRAMP authorization, check Attio's current compliance certifications against your requirements. Enterprise CRMs like Salesforce have a longer track record in regulated environments.

The cost of choosing wrong

The hidden cost of CRM choice isn't the subscription fee. It's the migration cost when you outgrow your system. Migrating a CRM means re-entering data, retraining your team, rebuilding workflows, and losing weeks of productivity during the transition. I've helped teams through migrations from HubSpot, from Salesforce, and from Affinity, and the consistent feedback is: "I wish we'd started with the right tool."

That doesn't mean every startup should start with Attio. It means you should choose a CRM that can grow with you through your next two to three years of scaling, not just your next two to three months. For most startups building a B2B sales motion, managing investor relationships, or running a SaaS pipeline, Attio is that tool.

But for the vast majority of startups -- teams running a SaaS sales motion, managing investor relationships, or building a services pipeline -- Attio is the right foundation. Start with it, design the data model right from day one, and you won't be migrating again in eighteen months.