Should you use Attio or Affinity for your investment firm?

By Daniel Hull ·

It depends on how much you want to own your system. Having migrated several firms from Affinity to Attio and set up others on Affinity from scratch, the honest answer is that they're both good products solving the same problem from different directions.

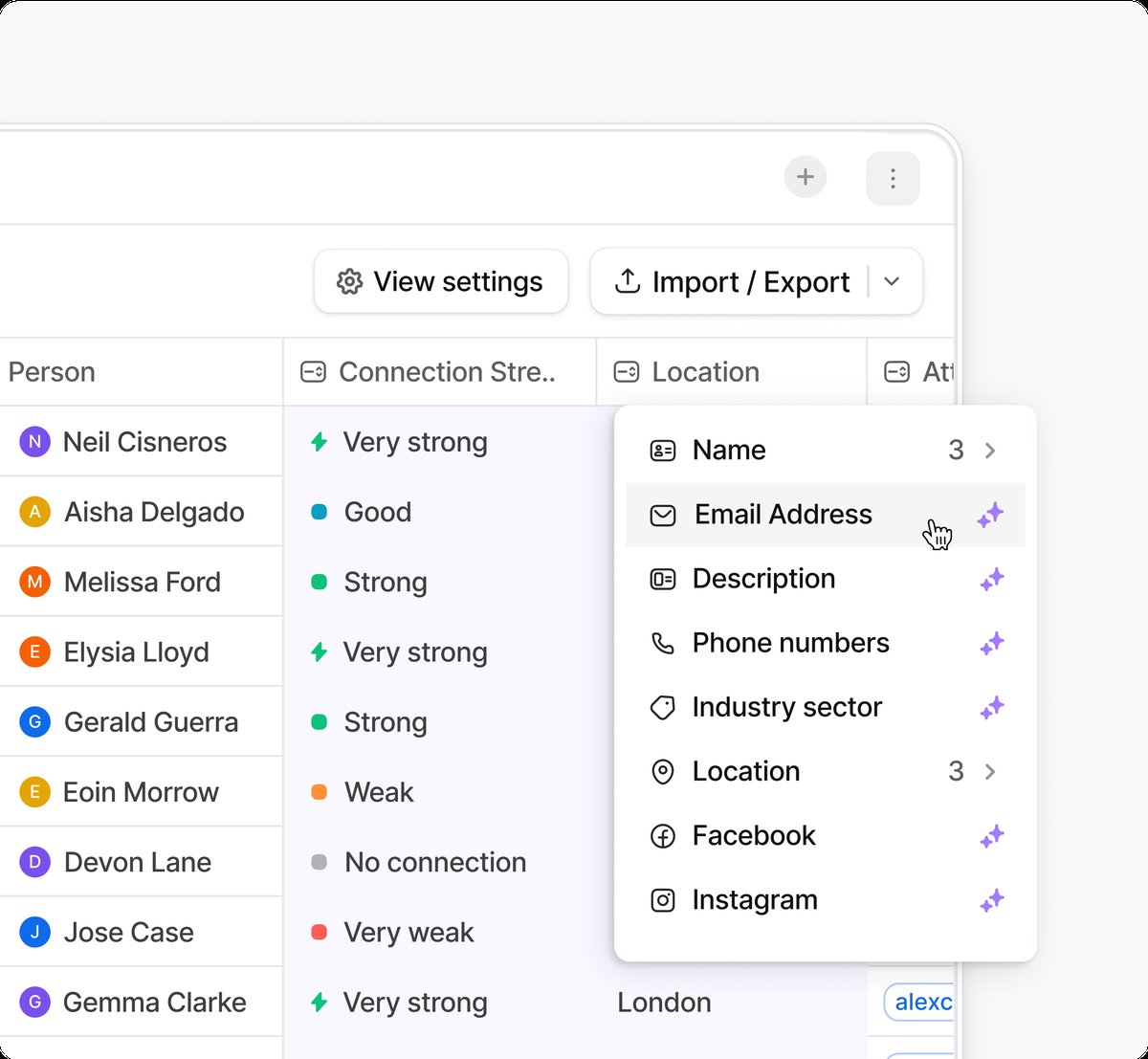

Attio's relationship intelligence surfaces connection strength across your firm's network.

Attio's relationship intelligence surfaces connection strength across your firm's network.

Affinity's strengths

Affinity's core strength is relationship intelligence. It syncs your email and calendar automatically, maps every interaction across your team, and builds a relationship strength score that surfaces warm intro paths you'd otherwise miss. For a VC firm that lives and dies by its network, that's genuinely powerful. You don't configure it, you just connect your accounts and it starts working. The deal flow pipeline is opinionated but functional, and the automatic activity capture saves analysts hours of manual CRM entry every week.

Where Affinity particularly shines:

- Intro path mapping. If you're trying to get a warm introduction to a founder, Affinity can show you every person in your firm's network who has a connection. It surfaces paths you wouldn't think to look for -- an LP who went to school with the founder, a portfolio company CEO who used to work with them, a co-investor who's on their board.

- Zero-config activity tracking. Every email, every meeting, every calendar event is automatically logged against the right contacts and companies. Your team never has to manually log a touchpoint. For firms where CRM adoption has historically been a struggle, this is a major win.

- Quick deployment. A new firm can be up and running on Affinity in a day. Connect email accounts, import your existing contacts, and the system starts building relationship maps immediately. There's very little "setup" in the traditional CRM sense.

Attio's strengths

Attio's core strength is flexibility. Custom objects let you model your exact workflow -- Deals, Portfolio Companies, LPs, Managed Funds, Investor Commitments -- as distinct objects with relationship attributes linking them together. Workflows give you real automation: trigger on a pipeline stage change, send a Slack notification, create a task, update a related record. AI features like Ask Attio and AI-powered attributes add a layer that Affinity doesn't match. If you want a system that adapts as your firm's processes evolve, Attio gives you that.

Where Attio particularly shines:

- Custom data model. You can build exactly the objects and relationships your firm needs. A growth equity fund tracking co-investment rights, board seats, and follow-on allocations alongside standard deal flow can model all of that natively. Affinity gives you a fixed set of objects (Companies, People, Opportunities, Lists) and you work within those constraints.

- Workflow automation. Attio's workflow builder lets you automate processes that Affinity requires manual effort for. When a deal moves to "Term Sheet," automatically create a task for legal review, notify the partnership via Slack, and update the company record's status. These multi-step automations save real operational time.

- Calculated attributes. Want to see total deployed capital per fund, average check size by stage, or days since last partner meeting per deal? Calculated attributes derive these metrics from your data automatically. Affinity doesn't have an equivalent feature.

- Reporting depth. Attio's reporting capabilities let you build views that Affinity's analytics can't match. Pipeline coverage by sector, conversion rates by deal source, time-to-close by deal size -- these are native in Attio.

The real trade-offs

The trade-offs are real though. Affinity gets you running faster. A new associate can start logging deals on day one without understanding a data model. Attio requires deliberate workspace design upfront -- choosing which custom objects to create, how to structure your pipeline status attributes, which relationship attributes connect what. Get it right and you have something far more powerful. Rush it and you'll rebuild in six months.

Here's a more detailed breakdown of the practical trade-offs:

| Factor | Affinity | Attio | |--------|----------|-------| | Setup time | 1-2 days | 1-2 weeks (done right) | | Relationship mapping | Best in class | Good and improving | | Data model flexibility | Limited | Unlimited | | Workflow automation | Basic | Advanced | | Reporting | Basic analytics | Full insight reports | | AI features | Limited | Ask Attio, AI attributes | | Learning curve | Low | Medium | | Pricing model | Per seat, tiered | Per seat, straightforward | | API/integrations | Standard | Growing ecosystem |

The relationship mapping gap is the one area where Affinity has a clear, structural advantage. Attio has relationship intelligence features and they're improving, but Affinity has been building this capability for years and it shows. If your firm's competitive advantage is purely network-driven -- if finding warm paths to founders is the single most important thing your CRM does -- Affinity earns its place.

Comparing data models for VC use cases

To make this concrete, here's how a standard VC firm's data model looks in each system:

In Affinity: You get Companies, People, Opportunities (your deals), and Lists. Lists are flexible groupings that can have custom fields. So you might have a "Deal Pipeline" list with stages, a "Portfolio" list for investments, and an "LP" list for your investors. The limitation is that Lists don't have the relational power of true objects. You can't create a "Funds" entity that links to specific LP commitments and automatically rolls up deployed capital.

In Attio: You create Companies, People, Deals (custom object), Funds (custom object), and optionally LP Commitments (custom object). Relationship attributes link Deals to Companies, Deals to Funds, LP Commitments to People and Funds. Your pipeline status attribute on Deals gives you a kanban view. Currency attributes on Deals and Funds give you financial tracking. Everything is connected, reportable, and automatable.

For a small seed fund with simple deal flow, the Affinity model is sufficient. For a multi-fund firm tracking follow-ons, LP reporting, and portfolio operations, Attio's data model is significantly more capable.

When each CRM fits best

Where I see firms land: if your team is under ten people, runs a relatively standard deal flow process, and values relationship mapping above all else, Affinity is a strong choice. If you're building a broader operational stack -- connecting your CRM to Clay for enrichment, pushing notifications to Slack via workflows, tracking LP commitments alongside deal flow, running portfolio operations out of the same system -- Attio is the better foundation.

More specific guidance based on firm type:

Early-stage VC (seed/Series A), team of 3-8: Affinity is likely the right choice. Your workflow is simple: source deals, evaluate, pass or invest. Relationship intelligence matters most. You don't need complex custom objects or automations yet.

Growth equity or multi-stage fund, team of 10-30: Attio is the better fit. You have more complex workflows (co-investment tracking, follow-on modeling, portfolio monitoring), more data to track, and more people who need different views of the same information. The data model flexibility pays for itself quickly.

PE firm with portfolio operations: Attio. You need to track deals, portfolio companies, operating metrics, board meeting cadences, and potentially fund accounting alongside traditional deal flow. Affinity's structure doesn't accommodate this breadth.

Family office or multi-asset investor: Depends on complexity. If you're primarily tracking relationships and deal flow across a small team, Affinity works. If you're managing multiple vehicles, LP relationships, and complex reporting requirements, Attio gives you the flexibility to model it all.

Fund of funds: Attio. You need to model Funds, GPs, and Commitments as distinct objects with complex relationships between them. This doesn't map well to Affinity's structure.

Which direction firms tend to go

One thing I'll say from experience: firms that outgrow Affinity almost always move to Attio. The reverse rarely happens. That's not a knock on Affinity -- it's excellent at what it does. But Attio's custom objects and workflow engine give you room to grow that Affinity's more structured approach doesn't. If you're already thinking about integrations and process automation, that's a signal to start with Attio. For a detailed look at what an Attio VC setup looks like in practice, see setting up Attio for a VC fund.

The migration path from Affinity to Attio is well-traveled at this point. I've written about the migration process in detail, and the short version is: it's doable in a few weeks with proper planning, but it's not trivial. You're not just moving data -- you're redesigning your data model, which is an opportunity to fix everything that frustrated you about your old setup. Most firms end up with a significantly better system on the other side.

Making the decision

If you're evaluating both platforms right now, here is what I'd recommend:

- Write down your top five CRM use cases. Not features, use cases. "I need to find warm intros to founders" is a use case. "I need to track LP commitments by fund" is a use case. "I need deal notifications in Slack" is a use case.

- Map each use case to both platforms. For each one, determine whether the platform handles it natively, requires a workaround, or doesn't support it at all.

- Weight the use cases by importance. If relationship mapping is your top priority and everything else is secondary, Affinity wins. If data model flexibility, automation, and reporting are your top priorities, Attio wins.

- Consider your growth trajectory. If you're going to add complexity in the next 12-24 months (new fund, more team members, portfolio operations), factor in which platform supports that growth without a migration.

Both platforms offer trials. Use them. But use them with real data and real workflows, not synthetic test cases. The difference between the two becomes obvious when you try to model your actual process, not a demo scenario.