How should you set up Attio for a VC fund?

By Daniel Hull ·

Set up your deal pipeline

Start with a custom Deals object. This is the backbone of your workspace. Every investment opportunity gets a record here, with a status attribute acting as your pipeline. Stages like "Sourced - First Meeting - Due Diligence - Term Sheet - Closed" give you a clear view of where everything stands. Add a currency attribute for check size, and you immediately get filtering, sorting, and reporting on deal values across the pipeline.

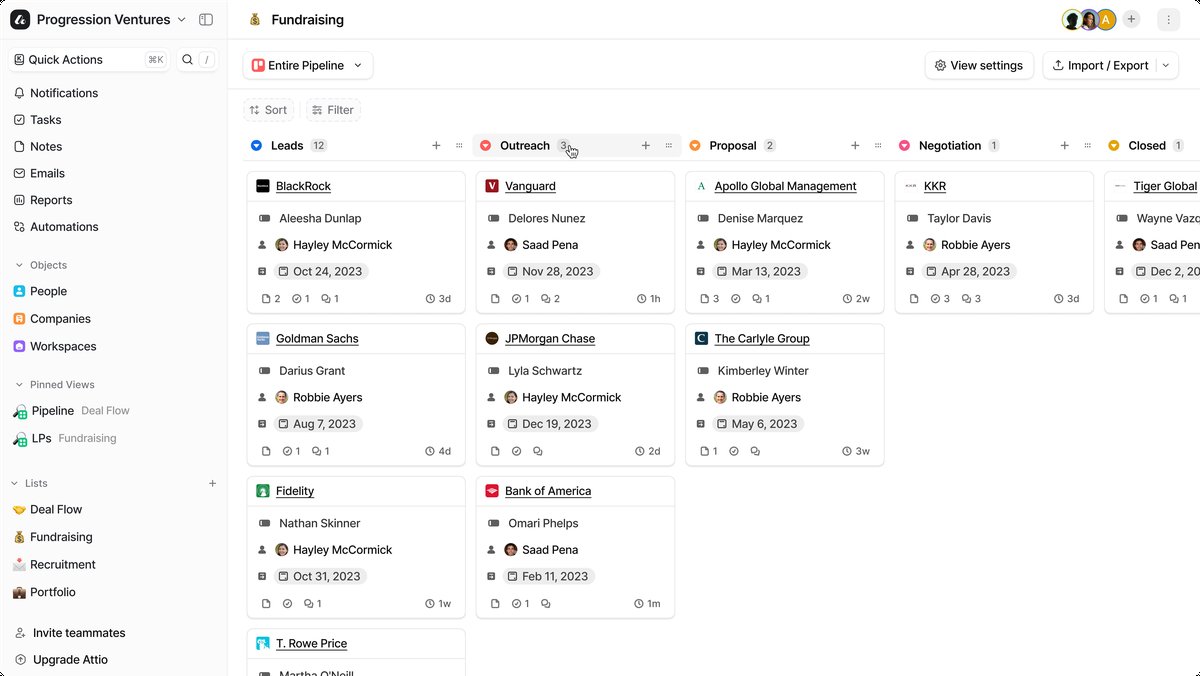

A VC workspace in Attio with a fundraising pipeline, deal flow lists, and portfolio views in the sidebar.

A VC workspace in Attio with a fundraising pipeline, deal flow lists, and portfolio views in the sidebar.

In my experience setting up Attio for 15+ VC funds, the pipeline stages need to reflect your actual investment process, not a generic template. A seed-stage fund evaluating 50 deals a week needs different stages than a growth equity firm doing 5 deals a quarter. Here's a pipeline that works well for early-stage funds:

- Sourced - initial awareness, someone on the team flagged the company

- First Meeting - introductory call completed

- Deep Dive - second or third meeting, serious interest

- Due Diligence - actively evaluating, reference calls in progress

- IC Review - presented to investment committee

- Term Sheet - terms offered

- Closed - investment completed

- Passed - decided not to proceed (add a "Pass Reason" select attribute)

The key thing I tell fund partners is to keep Passed as a terminal stage rather than deleting records. Those companies come back around in later rounds, and you want the history. A select attribute for "Pass Reason" (too early, valuation, market, team, competitive) gives you data on your own investment patterns over time.

Beyond check size, add these attributes to your Deals object from day one: a date attribute for "First Contact Date" (this tracks your response speed), a select for "Source" (referral, inbound, event, cold outreach, co-investor), and a select for "Sector" or "Thesis Area" that maps to your fund's investment thesis.

Connect deals to your network

The key architectural decision is how you connect Deals to the rest of your data. Use relationship attributes to link each Deal record to a Company and to the relevant People (founders, board members, co-investors). This means you're not duplicating contact information. You're building a graph of relationships that Attio keeps in sync across your workspace.

For VC specifically, the relationship graph is the product. A firm's ability to source, evaluate, and win deals depends almost entirely on network. In Attio, that network becomes queryable. When a new deal comes in, you can instantly see if anyone on your team has met the founders before, if a portfolio company has worked with them, or if a trusted co-investor has already looked at the company.

Here's how I structure the relationships for fund workspaces:

- Deal to Company (many-to-one) - every deal is linked to exactly one company

- Deal to People (many-to-many) - founders, board observers, co-investors all linked to the deal with a role context

- Company to People (many-to-many, system default) - the team members at each company

- Deal to Deal (self-referential, optional) - useful for linking follow-on rounds to the original investment

The People object in a VC workspace does heavy lifting. Founders, LPs, co-investors, advisors, portfolio company executives, and references all live here. Use tags or a select attribute for "Contact Type" to segment them. This means when you're doing reference calls for a new deal, you can search your existing People records and often find connections you didn't know you had.

For portfolio tracking, create a list filtered to closed deals. This gives you a portfolio view that pulls from the same underlying data as your active pipeline, just sliced differently. You can add list-specific attributes here for things like board seat status or reporting cadence without cluttering your deal flow view.

I also recommend a second list for "Watchlist" companies. These are companies you've passed on or aren't ready to invest in yet, but want to track. Add list-specific attributes for "Next Check-In Date" and "Watchlist Reason." This keeps your active pipeline clean while making sure promising companies don't fall through the cracks.

Track LPs and fund operations

If you're tracking LPs and fund operations, a custom Funds object works well. Link it to a separate LPs object (or just use People with a tag or status attribute if your LP base is small). Currency attributes on Fund records handle committed capital and deployed amounts. Most early-stage funds don't need this level of structure on day one, but Attio makes it straightforward to add later without reworking everything.

For funds that are actively managing LP relationships, here's the data model I recommend:

Funds object with attributes for fund name, vintage year, target size, committed capital, deployed capital, and fund status (Fundraising, Investing, Fully Deployed, Harvesting).

LPs object (or a list on People for smaller LP bases) with attributes for commitment amount, commitment date, LP type (institutional, family office, individual, fund-of-funds), and relationship attributes linking to the Fund.

Use calculated attributes here to roll up commitment amounts from LPs to the Fund record. A sum rollup gives you total committed capital that updates automatically as new LPs commit. A count rollup tells you how many LPs are in each fund. These numbers staying current without manual updates is worth the setup time.

If you're running multiple funds, the Funds object becomes essential. Each fund has its own LP base, its own deployment pace, and its own reporting requirements. Relationship attributes let you link deals to specific funds, so you know which fund made each investment and can track deployment against commitment by fund.

Build your reporting layer

VC reporting needs are different from sales team reporting, but the principles are the same: start with clean data and let Attio's reports surface insights automatically.

The reports every fund should have:

Pipeline snapshot. Total deal count and check size by stage. This tells you at a glance whether you have enough deal flow at the top of the funnel. If your IC Review stage is empty, you have a sourcing problem.

Source analysis. Where are your best deals coming from? Report on deal source against outcomes (passed, invested) to see which channels produce the highest-quality deal flow. In my experience, most funds are surprised to learn that their highest-volume source (often inbound) isn't their highest-conversion source.

Partner activity. Deals sourced and meetings taken per partner. This keeps the team accountable and surfaces if one partner is carrying the sourcing load.

Portfolio overview. A list view of all closed deals with current status, last check-in date, and any flagged issues. This is your quarterly board prep view.

Deployment pace. Capital deployed over time against the fund's investment period. This prevents the common problem of deploying too quickly early and running dry later, or being too cautious and facing pressure to deploy near the end of the investment period.

Automate the operational work

A few things I always set up for VC clients: an automation that creates a task when a deal hits Due Diligence, a filtered view per partner showing only their sourced deals, and relationship attributes linking People across both the deal side and the LP side. That last one is where Attio's data model really pays off: when a founder from one portfolio company shows up as a reference for a new deal, you see that connection immediately.

Here are the workflows I set up for nearly every fund workspace:

Due diligence trigger. When a deal moves to "Due Diligence," automatically create tasks for the standard DD checklist: financial model review, reference calls, market analysis, legal review. Each task gets assigned to the deal lead with a deadline.

IC prep automation. When a deal moves to "IC Review," send a Slack notification to the investment team channel with the deal details. This gives everyone time to review before the IC meeting.

Follow-up reminders. After a first meeting, create a task to send a follow-up within 48 hours. After passing on a deal, create a task to check back in 6 months. These small automations prevent deals from falling through the cracks.

LP update triggers. When a deal closes, add it to the quarterly LP update list. When a portfolio company hits a milestone (which you track via a status attribute on the portfolio list), flag it for the next LP communication.

What I see funds get wrong

After implementing Attio for funds ranging from solo GPs to teams of 20, these are the patterns that cause problems:

Tracking too little on passed deals. The companies you pass on are almost as valuable as the ones you invest in. Track why you passed, when you passed, and set a follow-up date. The best funds I work with review their passed companies quarterly and occasionally re-engage when the thesis has changed.

Not connecting co-investors to deals. Your co-investor relationships are a sourcing channel. When you link co-investors to deal records as People with a role, you build a searchable history of who invests alongside you and what they look at. This makes co-investment coordination much easier on the next deal.

Overcomplicating the workspace on day one. Start with a Deals object, relationship attributes to Companies and People, and two lists (active pipeline and portfolio). You can add Funds, LPs, and additional custom objects as the fund matures. I've seen first-time fund managers spend weeks building an elaborate workspace before they've closed a single deal. Get the pipeline working first.

Using the CRM for deal memo storage. Attio notes are great for meeting notes and quick updates, but your investment memos should live in Google Docs or Notion and be linked from the deal record. Don't fight the tool. Use Attio for structured data and relationship tracking, and use document tools for long-form analysis.

Keep the workspace lean at the start. A Deals object with a pipeline, relationship attributes to Companies and People, and a couple of lists for active deals and portfolio. You can layer on complexity as the fund matures and your operational needs become clearer. For a deeper look at the foundational decisions, see my guide on designing your Attio data model. And if you're coming from Affinity, the migration guide covers the specific considerations for moving your fund's data.